Capital-Pay.Net | FPX Solution, E Wallet, FPX, Online Payment Service Malaysia

• Encrypt Data

• Utilize payment tokenization

• Require Strong Passwords

• Implement 3d Secure

• Request Cvv Codes

• Apply Strong Customer Authentication

• Monitor Fraud Continuously

• Manage PCI Compliance

• Train Employees.

We assist you within a minute to go for live transaction:

Why sit for a long time when you can begin in no time. We have structured our procedure of account activation that empowers you to begin all transactions in under 5 minutes. Get in contact with our online payment solution. There is no need to open another account for gathering on the online payment. You can use our secure payment solution by providing your account number with IFSC code.

Transactions Management:

Managing your record has never been simple. Alter the details of your business, bank, notice settings, and detailing effectively at one single spot.

Account Management:

Managing your record has never been simple. Alter the details of your business, bank, notice settings, and detailing effectively at one single spot.

Online payments solution for setting up any business

Having all the important strategies of transaction from CapitalPay we will assist you in setting up them successfully for accomplishing the ideal outcome..

- Verification for 1 business day

- Modules and Plugins

- Protection form fraud

How CapitalPay is the Safest Online Payment Service?

CapitalPay is the platform that is enabling the Online Payment Service. We are providing our services and assistance to small businesses. With our Online Payment Gateway, you can digitize payments in a highly safe and secure environment.

Get your first payment with CapitalPay today and grow your business.

Is Online Payment Gateway safe?

With our Online Payment Gateway, we are providing safe payment APIs. We are detecting the fraud and providing the protective layer for the safe transaction.

You can enjoy the best online payment solution at CapitalPay!

Why choose CapitalPay for Online Banking Payment?

We are integrating our payment solution by introducing the payment gateway. Get instant pay with the CapitalPay online banking payment. We are offering you the best payment solution to run your business online.

What is E-Wallet?

Are you looking for card payments? If yes! E-wallet provides online transactions using electronic cards. You can make E-Wallet payments through a smartphone or a computer. E-Wallet is similar to a credit or debit card.

Manage Direct Payment Solutions with CapitalPay

Go live with CapitalPay and experience the future of direct payment solutions. The integration is the easiest, the payments platform is entirely new, the checkout is feature-rich, and the payment gateway is the best for small businesses.

Our Payment solutions processed billion of transactions which enable the payment to be performed digitally anytime and anywhere!

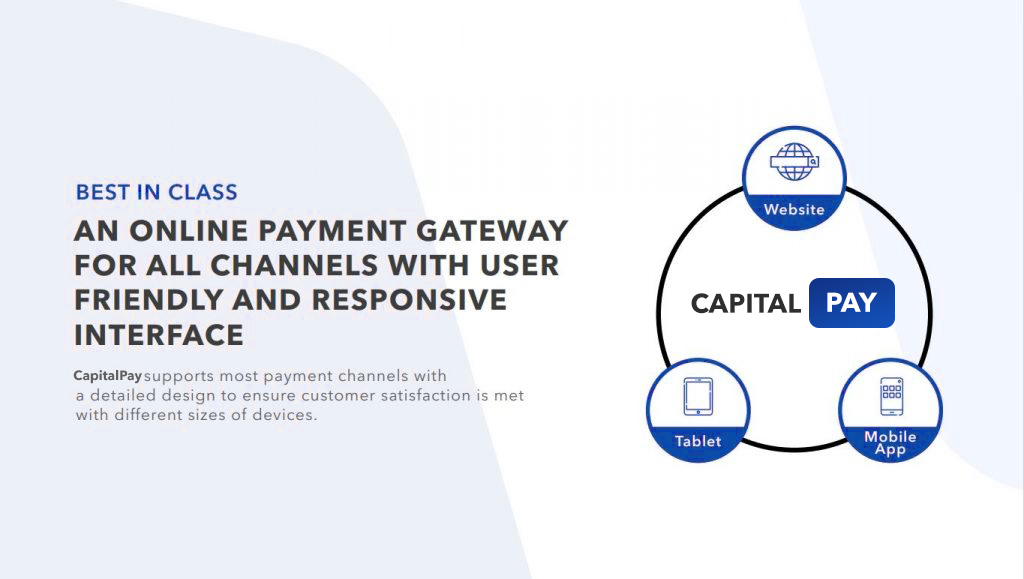

CapitalPay support most payment channels with a detailed design to ensure customer satisfaction is met with different sizes of devices. CapitalPay provide better customer experience for your customers.

CapitalPay is the best online payment gateway service provider, offering the following services:

- Digital Payment Platforms

- Digital Wallet Solutions

- B2b Payment Solutions

- E-commerce Payment Gateway

- Best Online Payment Gateway Service Providers

- Free Online Payment Gateway Malaysia

- Integrated Payment Solutions

- Bank Transfer Payment Solution

Our product suite enables businesses to accept, process, and disburse payments. In addition, our product suite gives you access to all payment solutions for small businesses, including credit cards, debit cards, net banking, UPI, and popular wallets.

Fast forward your business with CapitalPay. Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers, and borrow working capital.

Banks Support by CapitalPay Secure FPX Online Payment Gateway:

Indonesia

CapitalPay provides a safe Online Payment Gateway in Indonesia. CapitalPay supports BNI Bank, Nank BRI, BCA Bank and Mandiri Bank. Now, you can easily connect your bank account with the CapitalPay online payment gateway Indonesia.

Singapore

CapitalPay is now connected with the Top 5 Singaporean banks: DBS Bank, OCBC Bank, UOB Bank, and POSB Bank. If you have an account with any of these banks, you can easily send and receive money using the CapitalPay Secure Online Payment solution Singapore.

Vietnam

Do online transactions safely using the safest online payment gateway –CapitalPay. CapitalPay payment gateway is now linked with Vietcombank, VietinBank, sacombank, TechcomBank, BIDV Bank and MOMO Bank. Enjoy safe online payment gateway transactions!

Thailand

CapitalPay offers the best and the safe payment gateway solution in Thailand. The bank included in CapitalPay payment gateway are – CIMB THAI, Standard Chartered, SCB, Bank of Ayudhya, Kasikorn Bank, Government Saving Bank, Bangkok bank, and Thai QR payment.

Malaysia

Make your online payment process safe with CapitalPay online payment gateway Solution. Now, you can make online payments if you have a bank account in the following banks – Ambank, Alliance Bank, RHB, BSN, AFFIN Bank, Hong Leong bank, Bank Islam, Public Bank, Maybank, Bank Rakyat, CIMB bank, DuitNow, touch n Go slot eWallet.

FAQ(Frequently Asked Questions)

What Is The FPX Payment Method?

An Internet payment gateway, also known as FPX, allows real-time payments for online purchases or bill payments. The gateway is operated by Bank Negara Malaysia’s wholly-owned subsidiary, Payments Network Malaysia Sdn Bhd (PayNet). The FPX method is also a Malaysia-based payment method that allows customers to transact online using their bank credentials. To pay with FPX, customers are directed to their online banking environment, where they must perform a two-step authorization.

How Do I Use The FPX Service?

The FPX participating banks provide access to all your Internet Banking accounts. No registration is required to become a user; all you need is an internet banking account at any FPX bank using the same security credentials. FPX may be selected as a payment option at your chosen merchant website. If you choose your bank, you will be taken to Internet banking. Once the payment is processed, you will receive notifications from the merchant, your bank, and FPX.

How Can I Secure My Online Payment?

The threat of cyber theft and attacks over the internet has become very critical and one of the most important tasks for business owners. Here are a few Best Practices for Secure Online Payment 2022 Processing:

• Use IP addresses and billing addresses in matching• Encrypt Data

• Utilize payment tokenization

• Require Strong Passwords

• Implement 3d Secure

• Request Cvv Codes

• Apply Strong Customer Authentication

• Monitor Fraud Continuously

• Manage PCI Compliance

• Train Employees.

What Is The Most Secure Online Payment Method?

Those who use mobile payments are more likely to go to places that accept Apple Pay, Android Pay, and Samsung Pay. Mobile payments are both most secure and beneficial to business. Those who use mobile payments are most likely to seek out stores that accept them. You can pay online using your standard internet connection since it is more secure. You can also pay with your credit card – that way, you’re more protected. Or you can use a service like PayPal – so you don’t have to give out any financial details.

What Is A Secure Online Payment System?

Customers can pay online merchants or service providers using an online payment system. Customers’ payment information, usually debit, or credit card information, is secured by payment gateways, which channel them and payment processors during online payments. In addition, however, it aids in protecting a customer’s payment information during a transaction. Payment gateways protect payment information by encrypting sensitive details, such as credit card numbers, to ensure the information is passed securely between a customer and a payment processor.

Which Payment System Is Best For Small Businesses?

Stripe was created in 2010 to help small businesses accept payments online. The original purpose of Stripe was to make taking online payments easy with just a few lines of code. Since then, it has developed a range of products and services that make doing business online easier for start-ups and small businesses. The platform is now used by small local companies and world-renowned brands such as Amazon, Uber, Booking.com, Deliveroo, NBC, Just Eat, and Google. Whether you are integrating Stripe with an e-commerce platform or building your custom solution, this company offers scalable options that can be applied to both online and in-person payments.

How Can Small Businesses Accept Online Payments?

1.Credit Cards and Debit Cards. Whether online or in-person, credit and debit cards are the most popular forms of payment.

2.Automated Clearing House.

3.Many small businesses also accept ACH transfers.

4.Recurring Billing or Subscriptions.

5.Online Payments.

How Do I Set Up Online Business Payments?

To set up online business payments, follow the steps:

Pay with Credit Cards on Your Website.

Accept eCheck Payments By Direct Transfer.

Accept Mobile Payments.

Enable Click-To-Pay Email Invoicing.

Offer Automatic Bill Pay.

Get Paid Faster.

Give Clients Options. Offer Better Security.

Which Is The Best Online Payment Gateway?

As technology opens up new payment options and marketplaces, payment gateways are essential in helping businesses grow. Both brick-and-mortar and online sellers can offer secure ways to pay by credit card or digital wallet. There are many popular payment gateways, such as PayPal, Braintree, and Stripe. Think of the gateway as a virtual cash register in an online transaction. Like any cash register, it must be both convenient and secure.

How Do Payment Solutions Work?

Merchants submit transactions through the payment gateway. The gateway securely sends the transaction to the processor. The processor sends money to the merchant’s bank. The processor informs the payment gateway whether the transaction was approved or denied.

Once you’ve signed up with it, the payment gateway will process a transaction request when a customer enters his card details. The PSP then verifies the customer’s card details and determines whether sufficient funds are in the customer’s card account to complete the transaction.

What Is An Online Payment Solution?

The electronic payment system, or online payment system, is a way to pay for goods and services using an electronic medium without using checks or cash. Online payments are also known as electronic payments or electronic payments. PayPal provides online vendors, auction sites, Alipay, WeChat Pay, Paytm, Google Pay, and Amazon with a platform for electronic payments instead of traditional payment methods, such as checks and money orders.

What Is An Online Banking Payment?

Online banking, also known as e-banking or virtual banking is an electronic payment system that allows members of a bank or other financial institutions to conduct various financial transactions via the institution’s website. A payment network developed by banks in conjunction with technology companies is Online Banking ePayments (OBP). Consumers pay via push payment (credit transfer) through their financial institutions instead of pulling payments (debit transfer).

How Do I Make An Online Payment?

An online payment service facilitates making or receiving payments online without first setting up a bank account. Below are the steps for completing an online payment:

- Customers make purchases online.

- Payment gateways encrypt transaction information.

- Payment processors verify transaction details.

- The customer’s card company and bank approve funds.

- Payment processors request the transfer of funds.

- Merchants receive funds.

What Is An E-Wallet, And How Does It Work?

A eWallet is a secure, online platform or app that enables you to make purchases with retailers on-site, transfer or send money, and track rewards programs. The eWallet can be linked to your bank account or paid as you go with a prepayment option. Payments through mobile devices work just like regular transactions. To use a eWallet, follow these steps:

- Enter *120*321#

- Select ‘Send Money

- Select ‘eWallet’

- Then select the account from which you wish to send money.

- Key in the cellphone number you wish to send the money to.

- You must enter the amount you wish to send.

- You must select ‘Yes’ to send an SMS with the ATM PIN to the recipient for easy withdrawal.

- You must confirm the amount and the recipient’s phone number.

How Do I Set Up Ewallet?

The following steps will take you through the process of creating a bank’s e-wallet. Many banks now offer e-wallets that enable customers to make payments in one click via their mobile phones.

- Install the application

- Set up a PIN

- Link cards

- Process payments

- Points to remember

contactless payment solutions, payment platforms for small businesses, website payment solutions, online card payment solutions, malaysia bank online payment gateway, ecommerce payment gateway, malaysian online payment gateway